Marketplace ACA Coverage

Are you eligible for low or no cost health insurance?

Are you paying too much or not getting all the benefits you should be getting?

Find more insurance options with less effort and stress!

Let’s explore a few compelling reasons why having a health plan is essential for everyone.

1. Affordable health insurance: Financial concerns often deter people from getting insured. However, financial assistance has made health insurance more accessible than ever before. Some individuals may qualify for premiums as low as $0 per month, and savings are available across different income levels.

2. Protection against catastrophic medical expenses: Even with a healthy lifestyle, accidents and unexpected illnesses can occur, leading to overwhelming medical bills. Emergency care costs far exceed the amount you would pay for health insurance coverage.

3. Health insurance promotes wellness: In addition to financial protection, health insurance plays a vital role in maintaining good health.

4. Reduced out-of-pocket costs: Health insurance not only provides coverage after reaching the deductible but also offers savings on out-of-pocket expenses even before meeting the deductible.

Schedule a time for personal assistance or explore options on your own and self-enroll through our direct portal to the Marketplace.

Medicare

Are you turning 65 or already on Medicare? It’s crucial to explore all the available options in your area to find the Medicare plan that suits your needs. To make an informed decision, you should evaluate your medical insurance requirements, current coverage, budget, and preferred healthcare providers and facilities on an annual basis.

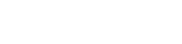

Medicare is divided into different parts:

**Part A: This covers inpatient care in hospitals or specific nursing facilities. It also helps pay for hospice care and home health care.

**Part B: This covers doctor appointments, outpatient services, home health care, medical equipment, and preventive screenings.

**Part C: Also known as Medicare Advantage, Part C is offered through private companies. It combines the coverage of Parts A, B, and often includes Part D (prescription drug coverage). Medicare Advantage plans may provide additional benefits beyond original Medicare, such as dental, vision, or hearing coverage.

**Part D: This focuses specifically on prescription drug coverage and vaccines. Part D plans are offered by private companies, allowing you to select the one that best meets your medication needs.

To help you navigate through Medicare, we offer a free guide to Medicare 2024. This guide will provide valuable information and insights.

You can schedule a free consultation with our experts who can help you explore the best options tailored to your needs. Don’t miss out on finding the right Medicare plan for you.

Off Marketplace Health Plans

Dental

A healthy smile can make all the difference in the world! Maintaining good oral health is crucial for overall well-being, as oral exams can detect signs of numerous diseases. Oral health problems are prevalent but preventable issues affecting many Americans. According to the CDC, 80% of Americans experience at least one cavity by age 34, and over 50% exhibit signs of gum disease. These issues are not just about maintaining a pleasant smile. They are interconnected with some health concerns:

- Diabetes: Gum infections can affect blood sugar control, impacting diabetic patients’ health.

- Heart Disease: Inflammation from gum disease may contribute to coronary artery disease. Maintaining oral health can reduce this risk.

- Pregnancy: Research suggests mothers with high oral bacteria levels may pass these onto their children, increasing the child’s risk of tooth decay.

- Self-esteem: Healthy teeth and gums are crucial for one’s self-esteem and self-perception.

Routine dental care helps catch issues early, avoiding costly treatments later on, while dental insurance provides coverage for preventive care and unexpected problems, ensuring financial security and peace of mind.

If you’re seeking regular and preventative coverage, dental insurance can be a cost-effective solution. It provides coverage for routine dental services, ultimately helping you save money on out-of-pocket expenses. You can compare various dental insurance plans to find the best option for you and your family.

Obtain a free quote today to identify the plan that suits your needs or get quotes and apply below.

Dental & Vision for Individuals